ESG Reporting Software Market Growth And Future Prospects Analyzed By 2032

ESG Reporting Software Market: Driving Sustainable Business Practices

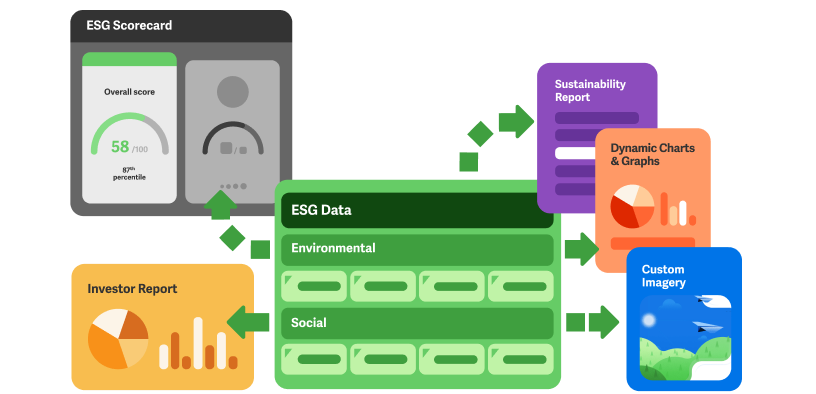

The burgeoning focus on environmental, social, and governance (ESG) factors is no longer a niche concern but a fundamental aspect of modern business operations. As stakeholders – from investors and regulators to customers and employees – increasingly demand transparency and accountability regarding a company's ESG performance, the need for efficient and accurate ESG reporting has become paramount. This escalating demand has propelled the ESG reporting software market into a significant growth trajectory, providing businesses with the tools necessary to collect, analyze, and report on their sustainability initiatives effectively. The market is characterized by a diverse landscape of software solutions, ranging from comprehensive platforms offering end-to-end ESG management to specialized tools focusing on specific reporting frameworks or data types. This evolution reflects the growing complexity of ESG reporting requirements and the need for sophisticated technology to navigate this intricate landscape.

The market's expansion is further fueled by the increasing integration of ESG considerations into investment decisions, supply chain management, and corporate risk assessments. As companies recognize the tangible benefits of strong ESG performance, including improved brand reputation, reduced operational costs, and enhanced access to capital, the adoption of dedicated reporting software becomes an indispensable part of their sustainability strategy. The competitive intensity within the market is rising, with both established enterprise software providers and innovative startups vying for market share, leading to continuous advancements in software capabilities and features.

Market Key Players Shaping the ESG Reporting Landscape

The ESG reporting software market is populated by a mix of established technology giants and specialized ESG software providers, each contributing to the market's growth and innovation. Prominent players include Workiva, a leading provider of cloud-based reporting and compliance solutions, whose platform is widely adopted for its integrated approach to financial and non-financial reporting. Cornerstone OnDemand, traditionally known for its human capital management software, has expanded its offerings to include ESG reporting capabilities, leveraging its existing relationships with large enterprises. SAP, a global leader in enterprise resource planning software, offers comprehensive sustainability solutions that integrate with its core business processes, providing a holistic view of ESG performance. Diligent Corporation, known for its governance, risk, and compliance (GRC) software, has significantly invested in its ESG reporting capabilities, offering tools for data collection, analysis, and disclosure. Accruent, a provider of facilities and asset management software, also offers solutions for environmental performance tracking and reporting.

Intelex Technologies, a Sphera company, specializes in environmental, health, and safety (EHS) and quality management software, with strong capabilities in environmental reporting. Cority, another key player in the EHS software market, provides robust tools for managing environmental data and generating sustainability reports. Sphera Solutions offers a broad portfolio of ESG solutions, including software for product sustainability, operational risk management, and sustainability reporting. These key players, along with numerous other specialized providers, are driving innovation in the market, offering a range of solutions tailored to different industry needs and reporting requirements. Their ongoing investments in research and development are leading to more sophisticated features, improved data analytics, and enhanced reporting functionalities, ultimately empowering businesses to achieve greater transparency and accountability in their ESG performance.

[PDF Brochure] Request for Sample Report:

https://www.marketresearchfuture.com/sample_request/22214

Market Segmentation: Tailoring Solutions to Diverse Needs

The ESG reporting software market can be segmented based on various factors, reflecting the diverse needs and requirements of businesses across different industries and sizes. A primary segmentation is by deployment type, including cloud-based and on-premise solutions. Cloud-based solutions are gaining increasing popularity due to their scalability, accessibility, and lower upfront costs, making them particularly attractive to small and medium-sized enterprises (SMEs). On-premise solutions, while requiring more significant infrastructure investment, are often preferred by large enterprises with stringent data security and control requirements. Another important segmentation is by enterprise size, distinguishing between solutions designed for large enterprises, SMEs, and micro-enterprises. Large enterprises typically require comprehensive platforms with advanced features and integration capabilities, while SMEs may opt for more streamlined and cost-effective solutions.

The market is also segmented by industry vertical, with specialized solutions emerging to address the unique ESG reporting challenges faced by sectors such as finance, manufacturing, energy, and retail. Furthermore, segmentation by functionality is crucial, differentiating between platforms that offer end-to-end ESG management, including data collection, analysis, reporting, and stakeholder engagement, and those focusing on specific aspects like carbon accounting, supply chain sustainability, or social impact measurement. This granular segmentation allows software providers to tailor their offerings to specific market needs, providing solutions that are both relevant and effective for different types of businesses and their unique ESG reporting requirements. The ability to cater to these diverse needs is a key driver of market growth and innovation.

Market Dynamics: Driving Forces and Restraints

The ESG reporting software market is influenced by a complex interplay of driving forces and restraints. The primary driver is the escalating regulatory pressure globally, with governments and regulatory bodies introducing mandatory ESG reporting requirements across various jurisdictions. This is compelling companies to adopt robust reporting systems to ensure compliance and avoid penalties. Investor demand is another significant driver, as institutional and individual investors increasingly incorporate ESG factors into their investment decisions, favoring companies with strong sustainability performance and transparent reporting. Growing stakeholder awareness and pressure from customers, employees, and civil society organizations are also pushing companies to prioritize ESG and report on their progress. The desire for improved brand reputation and competitive advantage is a strong motivator, as companies recognize that strong ESG performance can enhance their public image and attract environmentally and socially conscious consumers and talent.

Furthermore, the increasing recognition of the link between strong ESG performance and financial resilience is driving adoption, as companies understand that managing ESG risks can lead to long-term value creation. However, the market also faces certain restraints. The complexity and lack of standardization in ESG reporting frameworks can be a challenge for companies, requiring software that can accommodate various frameworks and provide flexibility in reporting. Data availability and quality remain significant hurdles, as companies struggle to collect reliable and consistent ESG data across their operations and supply chains. The cost of implementing and maintaining ESG reporting software can also be a barrier, particularly for smaller businesses with limited budgets. Finally, the lack of internal expertise and resources within companies to effectively utilize ESG reporting software can hinder adoption and implementation. Navigating these restraints while capitalizing on the driving forces is crucial for continued market growth.

Recent Developments Shaping the Future of ESG Reporting Software

The ESG reporting software market is experiencing rapid innovation and development, driven by evolving reporting requirements and technological advancements. A key recent development is the increasing integration of Artificial Intelligence (AI) and machine learning (ML) into ESG reporting platforms. AI and ML are being used to automate data collection from various sources, identify patterns and anomalies in ESG data, and provide predictive analytics on future performance. This enhances the efficiency and accuracy of reporting and provides valuable insights for decision-making. Another significant trend is the growing emphasis on supply chain sustainability and the development of software solutions specifically designed to track and report on ESG performance within complex supply chains. This reflects the increasing recognition that a company's ESG impact extends beyond its direct operations. The market is also seeing a rise in the development of solutions that facilitate double materiality assessments, which consider both the financial impact of ESG factors on a company and the impact of the company's operations on the environment and society.

Furthermore, there is a growing focus on providing more granular and real-time ESG data, moving beyond annual reporting to more frequent updates and dashboards that provide a dynamic view of performance. The development of solutions that support specific regulatory requirements, such as the EU Taxonomy and the Task Force on Climate-related Financial Disclosures (TCFD), is also a notable trend. Finally, there is an increasing focus on user-friendly interfaces and intuitive workflows to make ESG reporting accessible to a wider range of users within an organization. These recent developments are transforming the capabilities of ESG reporting software, making it more powerful, efficient, and insightful, ultimately empowering businesses to better manage their sustainability performance.

Regional Analysis: Varying Adoption and Drivers Across the Globe

The adoption and growth of the ESG reporting software market vary significantly across different regions, influenced by regional regulatory landscapes, investor sentiment, and corporate sustainability maturity. North America is a leading market for ESG reporting software, driven by strong investor demand for ESG data, increasing regulatory focus on climate-related disclosures, and a relatively mature corporate sustainability landscape. The presence of major technology companies and a strong venture capital ecosystem also contributes to the region's dominance. Europe is another significant market, characterized by stringent ESG regulations, such as the Non-Financial Reporting Directive (NFRD) and the upcoming Corporate Sustainability Reporting Directive (CSRD), which are mandating comprehensive ESG reporting for a wide range of companies. Strong public awareness and pressure from civil society organizations also contribute to the high adoption rates in Europe.

The Asia-Pacific region is experiencing rapid growth in the ESG reporting software market, driven by increasing awareness of climate change impacts, growing investor interest in sustainable investments, and evolving regulatory frameworks in countries like China, Japan, and Australia. While starting from a lower base compared to North America and Europe, the region presents significant growth potential. Latin America and the Middle East and Africa are also witnessing increasing interest in ESG reporting, albeit at an earlier stage of development. Growing awareness of climate risks, increasing foreign investment with ESG considerations, and nascent regulatory initiatives are driving the adoption of ESG reporting software in these regions. The regional variations in market maturity and drivers highlight the need for software providers to tailor their strategies and solutions to the specific needs and regulatory environments of each region. Understanding these regional nuances is crucial for successful market penetration and growth.

Browse In-depth Market Research Report:

https://www.marketresearchfuture.com/reports/esg-reporting-software-market-22214

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: [email protected]

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness