-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Статьи пользователей

Financial Crime and Fraud Management Solutions Market Overview, Growth Analysis, Trends and Forecast By 2029

Global Demand Outlook for Executive Summary Financial Crime and Fraud Management Solutions Market Size and Share

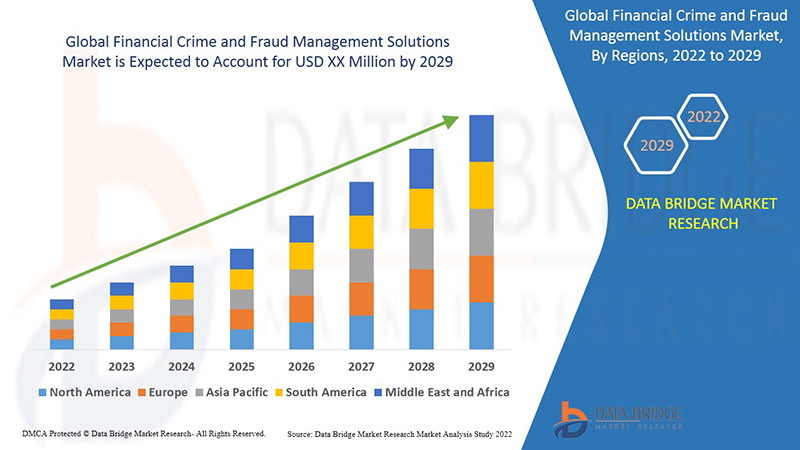

Data Bridge Market Research analyses that the financial crime and fraud management solutions market will exhibit a CAGR of 4.7% for the forecast period of 2022-2029.

This Financial Crime and Fraud Management Solutions Market report includes a wide-ranging evaluation of the market’s growth prospects and restrictions. The Financial Crime and Fraud Management Solutions Market report provides estimations about the growth rate and the market value in Financial Crime and Fraud Management Solutions Market industry based on market dynamics and growth inducing factors. Global Financial Crime and Fraud Management Solutions Market report studies the industry abilities for each geographical region based on the customer purchasing patterns, macroeconomic parameters, development rate, and market demand and supply states. In addition, this Financial Crime and Fraud Management Solutions Market report also endows with top to bottom estimation of the market with respect to income and developing business sector.

Financial Crime and Fraud Management Solutions Market report is an important source of guidance for companies and individuals offering industry chain structure, business strategies and proposals for new project investments. This Financial Crime and Fraud Management Solutions Market report has a chapter on the Global Financial Crime and Fraud Management Solutions Market and all its associated companies with their profiles, which provides valuable data related to their outlook in terms of finances, product portfolios, investment plans, and marketing and business strategies. The Financial Crime and Fraud Management Solutions Market report is worked upon with the best-practice models, comprehensive market analysis and research methodologies so that clients achieve perfect market segmentation and insights.

Get strategic knowledge, trends, and forecasts with our Financial Crime and Fraud Management Solutions Market report. Full report available for download:

https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market

Financial Crime and Fraud Management Solutions Market Exploration

**Segments**

- **Solution Type**: The global financial crime and fraud management solutions market can be segmented based on solution type into fraud detection and prevention, compliance management, authentication, governance, risk, and compliance (GRC), and others. The fraud detection and prevention segment is expected to witness significant growth with the increasing sophistication of fraudsters and cybercriminals, driving the demand for advanced solutions to mitigate financial crimes effectively. Compliance management solutions are also crucial for businesses to adhere to regulatory requirements and avoid penalties.

- **Deployment Type**: The market can also be segmented based on deployment type into cloud-based and on-premises solutions. Cloud-based solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness. On-premises solutions are preferred by organizations that require more control over their data and security protocols, especially in highly regulated industries.

- **Organization Size**: In terms of organization size, the market can be categorized into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly realizing the importance of investing in financial crime and fraud management solutions to protect their businesses from potential risks. Large enterprises, on the other hand, are adopting advanced solutions to combat sophisticated financial crimes on a larger scale.

**Market Players**

- **ACI Worldwide**

- **Fiserv Inc.**

- **SAP SE**

- **Experian Information Solutions, Inc.**

- **FIS**

- **BAE Systems**

- **NICE Actimize**

- **SAS Institute Inc.**

- **ACI Worldwide**

- **Symantec Corporation**

The global financial crime and fraud management solutions market is highly competitive with key players focusing on technological advancements, strategic collaborations, and mergers and acquisitions to gain a competitive edge. These market players offer a wide range of solutions tailored to meet the diverse needs of businesses across various industries.

The global financial crime and fraud management solutions market is witnessing a steady rise in demand owing to the increasing sophistication of fraudsters and cybercriminal activities across various industries. As organizations strive to protect themselves from financial crimes and fraud, the need for advanced solutions has become paramount. The segment of fraud detection and prevention is expected to experience substantial growth as businesses seek robust mechanisms to combat evolving fraud tactics effectively. Compliance management solutions are also gaining prominence as regulatory requirements become more stringent, pushing organizations to invest in compliance technologies to avoid penalties and ensure adherence to industry regulations.

When it comes to deployment type, the market is divided between cloud-based and on-premises solutions. Cloud-based offerings are becoming increasingly popular due to their scalability, flexibility, and cost-effectiveness, making them an attractive choice for organizations looking to streamline their operations and enhance their security measures. On the other hand, on-premises solutions are favored by companies that prioritize data control and security, particularly in highly regulated sectors where maintaining strict compliance is crucial.

In terms of organization size, both small and medium-sized enterprises (SMEs) and large enterprises are recognizing the importance of investing in financial crime and fraud management solutions. SMEs are realizing the significance of bolstering their cybersecurity measures to safeguard their operations from potential threats, while large enterprises are scaling up their efforts to combat complex financial crimes on a broader scale. This shift towards proactive risk management practices is driving the adoption of advanced solutions tailored to suit the specific needs of businesses across different sizes and sectors.

Key market players such as ACI Worldwide, Fiserv Inc., SAP SE, Experian Information Solutions, Inc., and others are actively engaged in developing innovative technologies and forming strategic partnerships to stay competitive in the market. These players are continuously investing in research and development to enhance their product offerings and meet the evolving needs of customers. Collaborations and mergers and acquisitions play a crucial role in expanding market reach and gaining a competitive advantage in the global financial crime and fraud management solutions landscape.

Overall, the financial crime and fraud management solutions market is poised for significant growth as organizations increase their focus on fortifying their defense mechanisms against financial crimes and fraud. With technological advancements and strategic initiatives driving market dynamics, the competitive landscape is expected to further intensify, leading to continuous innovation and development of comprehensive solutions to combat emerging threats in the digital era.The global financial crime and fraud management solutions market is witnessing a transformative phase as organizations confront the escalating challenges posed by sophisticated fraudsters and cybercriminal activities. In response to the evolving threat landscape, businesses are increasingly turning to advanced solutions that offer robust fraud detection and prevention capabilities. The rising demand for compliance management solutions is driven by a tightening regulatory environment, compelling companies to invest in technologies that ensure adherence to legal requirements and safeguard against financial penalties and reputational damage.

Regarding deployment types, the market exhibits a notable shift towards cloud-based solutions due to their inherent advantages such as scalability, agility, and cost-effectiveness. Cloud-based offerings are gaining traction among organizations seeking to enhance operational efficiency and strengthen their security posture. In contrast, on-premises solutions remain a preferred choice for businesses operating in highly regulated industries where data control and security protocols are paramount.

In terms of organizational size, both small and medium-sized enterprises (SMEs) and large enterprises are recognizing the critical role of financial crime and fraud management solutions in safeguarding their operations. SMEs are increasingly investing in cybersecurity measures to mitigate risks and protect their businesses from potential threats. Large enterprises, with their heightened exposure to complex financial crimes on a larger scale, are leveraging advanced solutions to bolster their defense mechanisms and fortify their resilience against evolving threats.

Key market players such as ACI Worldwide, Fiserv Inc., SAP SE, Experian Information Solutions, Inc., and others are at the forefront of driving innovation and shaping the competitive landscape of the financial crime and fraud management solutions market. These industry leaders are actively engaged in research and development initiatives to deliver cutting-edge technologies that address the diverse needs of businesses across different sectors. Strategic collaborations, mergers, and acquisitions play a pivotal role in enabling market players to expand their market reach and gain a competitive edge in an increasingly competitive market environment.

As organizations intensify their focus on proactive risk management practices and technological advancements continue to redefine the financial crime and fraud management landscape, the market is poised for substantial growth. The relentless pursuit of innovation and the pursuit of comprehensive solutions to combat emerging threats in the digital age are expected to drive continuous evolution and transformation within the market, paving the way for enhanced security and resilience against financial crimes and fraud.

See how much of the market the company dominates

https://www.databridgemarketresearch.com/reports/global-financial-crime-and-fraud-management-solutions-market/companies

Essential Analyst Questions for Financial Crime and Fraud Management Solutions Market Forecasting

- How much is the Financial Crime and Fraud Management Solutions Market worth globally?

- What is the expected CAGR for this Financial Crime and Fraud Management Solutions Market industry?

- What are the segmentation strategies used in the Financial Crime and Fraud Management Solutions Market report?

- Which firms are dominating at the global Financial Crime and Fraud Management Solutions Market level?

- What nation-level forecasts are available for Financial Crime and Fraud Management Solutions Market?

- What multinational corporations are Financial Crime and Fraud Management Solutions Market leading in sales?

Browse More Reports:

Global Heated Razor Starter Kits Market

Global Stye Drug Market

Global Ultraviolet Disinfection Equipment Market

Global Energy Recovery Ventilator Market

Global Voice Picking Solution Market

Global Sialorrhea Market

Asia-Pacific Dermatology Diagnostic Devices Market

Europe Polyglycerol Market

Global Sleep Apnea Devices Market

Asia-Pacific Water Detection Sensors Market

Global Remote Sensing Technology Market

Europe Hydrochloric Acid Market

Global Soy-Based Surfactants Market

Global Drill Bit Market

North America Automotive Sensor and Camera Technologies Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness