Private Pension Insurance Market Size, Share, Trends & Growth Report, 2033 | UnivDatos

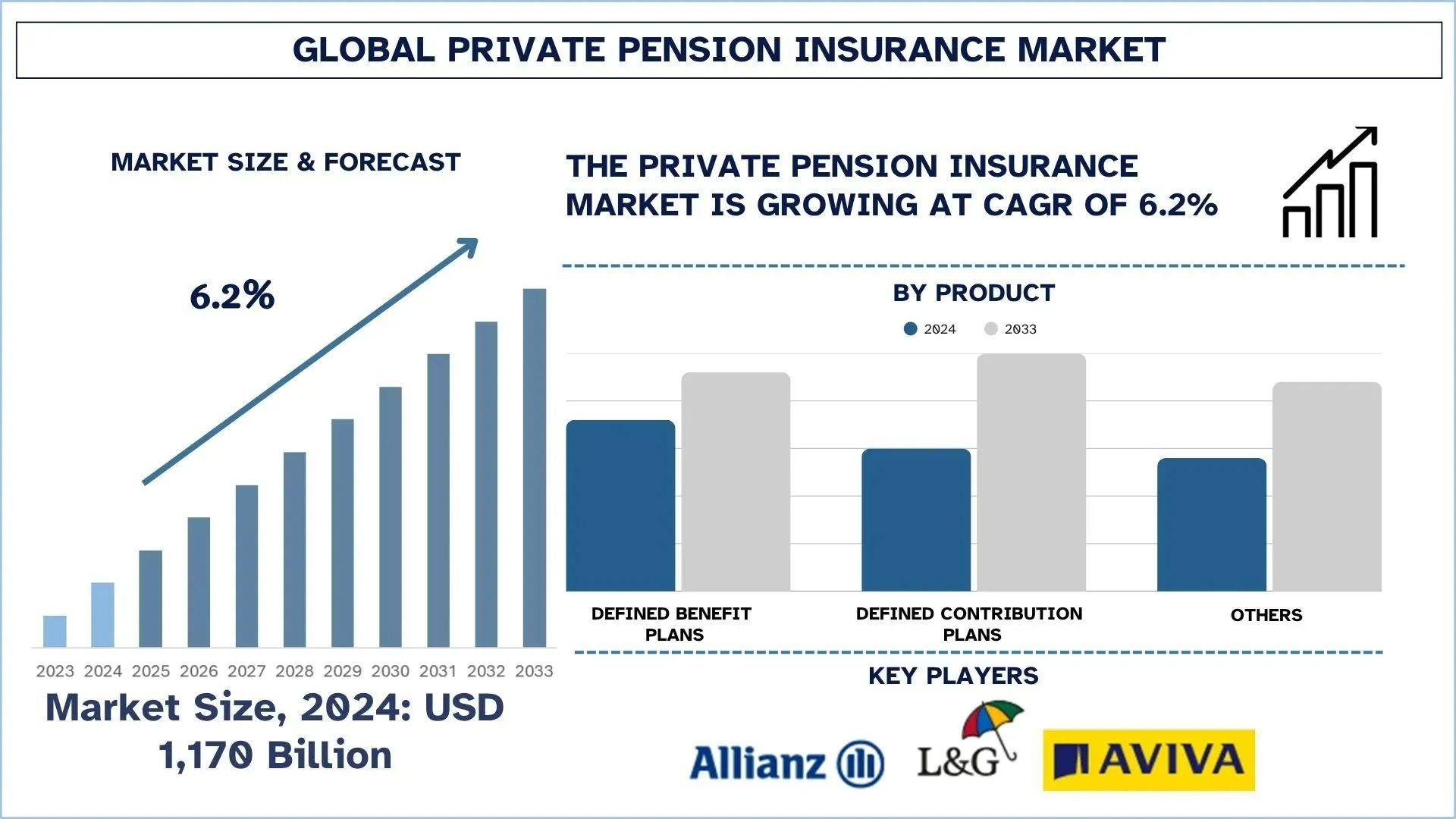

According to a new report by UnivDatos, the Private Pension Insurance Market is expected to reach USD Billion in 2033 by growing at a CAGR of 6.2%. Growing life expectancy, mounting awareness about retirement planning, and the transition from state-funded pensions to self-funded retirement options are pushing the private pension insurance market to growth. As conflicts in public pension systems have become unsustainable, individuals are seeking better and more reliable retirement income from private insurers. Additionally, a growing middle-class population, especially in the emerging economies, and rising disposable income are fuelling the demand. Moreover, financial institutions are launching pension products that are customizable, investment-linked, and targeting the apparently younger demographics, leading to the growth of the private pension insurance market.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/private-pension-insurance-market?popup=report-enquiry

Aging Population

More people living longer makes it necessary for individuals to focus on private pension insurance to sustain their financial situation during retirement. As a growing number of people in both developed and rapidly aging emerging economies are 60 and above, people are paying more attention to the weaknesses of state pensions and wishing for alternative income sources. Due to the shift in the population, the public pension system is under extra pressure, making people explore other ways to plan for retirement. For instance, according to the latest UN forecasts, by 2050, the number of people aged 65 and older is set to almost double from 857 million to 1,578 million. To support long-term financial sustainability, there is a need to provide efficient and sustainable pension insurance to the old age people. As private pension insurance is flexible, lets people choose their own investments, and promises guaranteed income after retirement, it interests several older adults. As more people become older, the danger of outliving their savings makes it even more necessary to have a reliable income via insurance. For this reason, insurance companies are selling more annuities and tailored pensions, which should support the market’s growth in the coming years due to the aging population.

Click here to view the Report Description & TOC https://univdatos.com/reports/private-pension-insurance-market

According to the report, the Asia-Pacific region holds the largest market share in the Global Private Pension Insurance Market

It is estimated that the private pension insurance market in the Asia-Pacific area will expand rapidly because of an older population, more middle-class families, and a rise in concern for the future. Countries like India, China, and those in Southeast Asia are seeing people become more aware of the fact that the state pension is insufficient, and they should plan their own retirement. More knowledge about finances, digital resources in insurance, and pension changes introduced by the authorities are pushing the market to expand. Private pension products are used by very few in the region, which means the industry has plenty of opportunities for expansion in the Asia-Pacific.

Related Report

Private Health Insurance Market: Current Analysis and Forecast (2024-2032)

Insurance Rating Platform Market: Current Analysis and Forecast (2024-2032)

Dental Insurance Market: Current Analysis and Forecast (2025-2033)

Pet Insurance Market: Current Analysis and Forecast (2025-2033)

Cyber Insurance Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - [email protected]

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness