-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Evènements

-

Blogs

Malfunction Insurance Market Business Status and Future Outlook Analysis 2032

"Global Demand Outlook for Executive Summary Malfunction Insurance Market Size and Share

CAGR Value

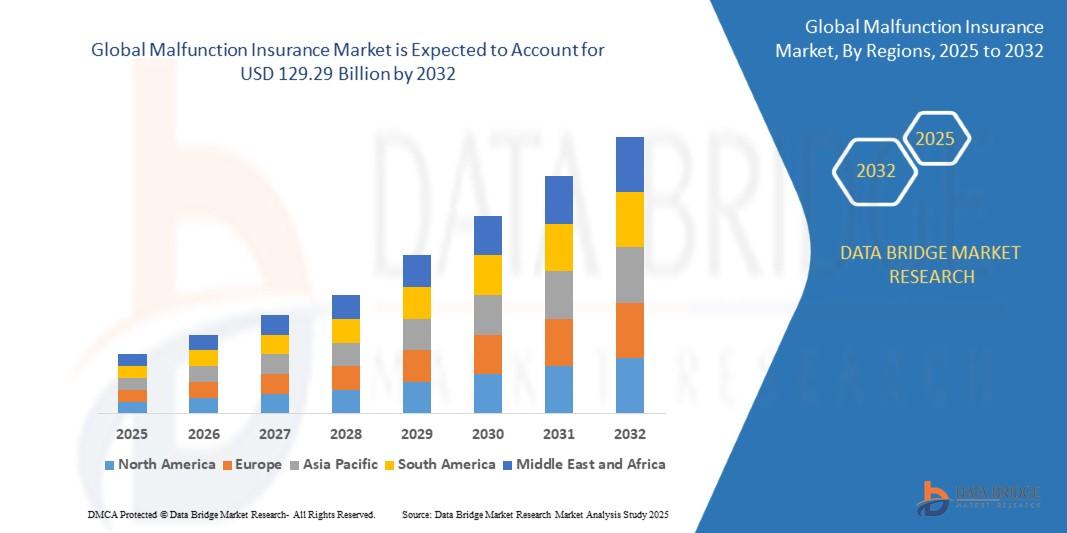

The global malfunction insurance market size was valued at USD 55.30 billion in 2024 and is projected to reach USD 129.29 billion by 2032, with a CAGR of 11.20% during the forecast period of 2025 to 2032.

Malfunction Insurance Market report supports businesses to thrive in the market by providing them with an array of insights about the market and the Malfunction Insurance Market industry. Inputs from various industry experts, essential for the detailed market analysis, have been employed very carefully to generate this finest market research report. The report presents with a telescopic view of the competitive landscape to the client so that they can plan the strategies accordingly. e.g. strategic planning supports businesses improve and enhance their products which customers will desire to buy. These CAGR values play a vital role in determining the costing and investment values or strategies.

The statistical and numerical data such as facts and figures are signified very properly in the significant Malfunction Insurance Market report by using charts, tables or graphs. Details about competitive landscape plays very important role in deciding about the enrichments required in the product already in the market or the future product. In addition, this market report analyzes the market status, market share, current trends, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors. To formulate the winning Malfunction Insurance Market report in an outstanding manner, most up-to-date and advanced tools and techniques have been utilized so that client achieves maximum benefits.

Get strategic knowledge, trends, and forecasts with our Malfunction Insurance Market report. Full report available for download:

https://www.databridgemarketresearch.com/reports/global-malfunction-insurance-market

Malfunction Insurance Market Exploration

**Segments**

- **Type:** The global malfunction insurance market can be segmented based on type into product malfunction insurance and service malfunction insurance. Product malfunction insurance covers defects in physical products such as electronics, appliances, and machinery. On the other hand, service malfunction insurance protects against errors or failures in services provided by businesses such as software development, consulting, and maintenance services.

- **Coverage:** Another crucial segment of the malfunction insurance market is coverage, which includes liability coverage, property coverage, financial loss coverage, and business interruption coverage. Liability coverage protects businesses from legal claims resulting from malfunctions in products or services, while property coverage compensates for damages to physical assets. Financial loss coverage covers losses incurred due to malfunctions, and business interruption coverage helps businesses recover lost income during downtime caused by malfunctions.

- **End-User:** The market can also be segmented based on end-users, including individual consumers, small and medium enterprises (SMEs), and large corporations. Individual consumers may opt for malfunction insurance for personal gadgets and appliances, while SMEs and large corporations may invest in coverage to protect their operations and mitigate financial risks associated with malfunctions.

**Market Players**

- **Allianz**: Allianz is a prominent player in the global malfunction insurance market, offering a range of coverage options for businesses and consumers. With a strong global presence and a reputation for reliability, Allianz caters to diverse client needs and provides comprehensive solutions for malfunction risks.

- **AIG (American International Group)**: AIG is another key player in the malfunction insurance market, known for its innovative products and risk management services. With a focus on technology-driven solutions and customized coverage options, AIG serves businesses across various industries and sizes, addressing specific malfunction concerns effectively.

- **Chubb Limited**: Chubb Limited is a leading provider of malfunction insurance, specializing in tailored solutions for complex business risks. With a commitment to excellence and customer-centric approach, Chubb offers extensive coverage for product and service malfunctions, safeguarding clients against financial losses and reputation damage.

- **Zurich Insurance Group**: Zurich Insurance Group is a distinguished insurer in the malfunction insurance market, offering comprehensive policies and risk assessment services. By leveraging data analytics and industry expertise, Zurich provides proactive malfunction protection strategies to clients, enhancing their resilience to operational disruptions.

The global malfunction insurance market is characterized by increasing demand for comprehensive coverage solutions, rising awareness about risk mitigation, and evolving regulations governing product and service quality. As businesses and consumers alike recognize the importance of safeguarding against malfunctions that can lead to financial losses and reputation damage, the market is expected to witness steady growth in the coming years. Technological advancements, such as IoT integration and predictive analytics, are also shaping the market dynamics by enabling proactive malfunction prevention and efficient claims processing. Overall, the malfunction insurance market presents lucrative opportunities for insurers, reinsurers, and technology providers to innovate and collaborate in delivering value-added services to a diverse range of clients.

The global malfunction insurance market is witnessing a paradigm shift driven by the increasing complexity and interconnectivity of products and services across industries. One of the emerging trends in the market is the integration of artificial intelligence and machine learning algorithms to enhance risk assessment and claims processing efficiency. Insurers are leveraging these technologies to analyze vast amounts of data in real-time, enabling them to detect potential malfunctions early and provide proactive risk management solutions to clients. This trend is reshaping the traditional insurance landscape by offering more personalized and predictive malfunction coverage options to businesses and consumers. Moreover, insurers are focusing on collaboration and partnerships with technology firms to develop innovative insurtech solutions that address evolving client needs and regulatory requirements in the malfunction insurance space.

Another key trend in the malfunction insurance market is the growing emphasis on sustainability and environmental responsibility. Insurers are recognizing the impact of product malfunctions on the environment and are incorporating eco-friendly coverage options in their insurance portfolios. This includes providing coverage for sustainable product design, green energy technologies, and environmentally friendly services to promote sustainable practices among businesses and consumers. With the increasing consumer awareness and regulatory pressure on companies to adopt sustainable practices, insurers are well-positioned to offer tailor-made malfunction insurance solutions that align with the growing sustainability trends in the market.

Furthermore, the market is witnessing a surge in demand for parametric malfunction insurance products, which offer predefined payout structures based on specific triggers such as sensor data or weather conditions. These parametric insurance products enable faster claims processing and eliminate the need for lengthy investigations, providing clients with more transparent and efficient coverage solutions. Insurers are leveraging parametric insurance to cater to industries prone to sudden malfunctions, such as manufacturing, transportation, and healthcare, where downtime can have severe financial implications. This shift towards parametric insurance indicates a broader industry trend towards more agile, data-driven insurance products that offer greater flexibility and responsiveness to clients' malfunction risk exposures.

In conclusion, the global malfunction insurance market is undergoing significant transformations driven by technological advancements, sustainability concerns, and the rise of parametric insurance solutions. Insurers are adapting their offerings to meet the evolving needs of businesses and consumers seeking comprehensive and innovative malfunction coverage options. With the market poised for continued growth and innovation, stakeholders across the insurance value chain have the opportunity to capitalize on these trends by developing tailored solutions that address the unique challenges presented by malfunctions in today's interconnected and fast-paced business environment.The global malfunction insurance market is experiencing a profound shift towards more advanced and tailored coverage solutions to address the increasing complexity and interconnectedness of products and services in various industries. One notable trend driving this transformation is the integration of artificial intelligence and machine learning algorithms, which are revolutionizing risk assessment and claims processing in the insurance sector. Insurers are leveraging these technologies to analyze vast amounts of data in real-time, enabling them to proactively detect potential malfunctions and offer personalized risk management strategies to clients. By embracing AI and machine learning, insurers can provide more predictive and efficient malfunction coverage options, enhancing their competitiveness in the market.

Moreover, a growing focus on sustainability and environmental responsibility is shaping the malfunction insurance landscape. Insurers are acknowledging the environmental impact of product malfunctions and are incorporating eco-friendly coverage choices in their portfolios. This includes coverage for sustainable product design, green energy technologies, and environmentally conscious services to encourage sustainable practices among businesses and consumers. As consumer awareness and regulatory pressures drive companies towards sustainability, insurers have the opportunity to offer custom malfunction insurance solutions that align with the burgeoning sustainability trends in the market, thus catering to a more environmentally-conscious client base and promoting sustainable business practices.

Additionally, there is a rising demand for parametric malfunction insurance products, which offer predefined payout structures based on specific triggers such as sensor data or weather conditions. These parametric insurance solutions streamline claims processing and eliminate the need for lengthy investigations, providing clients with transparent and efficient coverage options. Insurers are leveraging parametric insurance to cater to industries vulnerable to sudden malfunctions, like manufacturing, transportation, and healthcare, where downtime can result in significant financial repercussions. This shift towards parametric insurance signifies a broader industry movement towards agile, data-driven insurance products that offer flexibility and responsiveness to clients' malfunction risk exposures.

In conclusion, the global malfunction insurance market is undergoing significant evolution driven by technological advancements, sustainability considerations, and the adoption of parametric insurance solutions. Insurers are adapting their offerings to meet the changing needs of businesses and consumers seeking comprehensive and innovative malfunction coverage options. With the market poised for continuous growth and innovation, stakeholders in the insurance sector have the opportunity to capitalize on these trends by developing tailored solutions that address the unique challenges presented by malfunctions in today's interconnected and fast-paced business environment.

See how much of the market the company dominates

https://www.databridgemarketresearch.com/reports/global-malfunction-insurance-market/companies

Essential Analyst Questions for Malfunction Insurance Market Forecasting

- What is the total addressable market of the Malfunction Insurance Market?

- What long-term growth patterns are forecasted?

- What product types dominate the Malfunction Insurance Market landscape?

- Who are the pioneering players in this sector?

- What has been the response to recent product launches?

- What countries offer the highest Malfunction Insurance Market potential?

- Which region has the highest product penetration?

- What countries are leading in per-capita consumption?

- Where are the most lucrative Malfunction Insurance Market located?

- What Malfunction Insurance Market forces are contributing to rapid change?

Browse More Reports:

Europe Plant Breeding and CRISPR Plant Market

Europe Talc Market

Global Hospital Workforce Management Market

Global Microencapsulated Pesticides Market

Global Fluid Management Systems Market

Global Mannitol Market

Global Feed Micronutrients Market

Global Orthodontic Supplies Market

Middle East and Africa Gamma Butyrolactone Market

Global Mercaptopropionic Acid Market

Global Intravascular Ultrasound (IVUS) Market

Global Talc Market

Global Tricyclic antidepressants Market

Global High Temperature Grease Market

South East Asia and Middle East and Africa Talc Market

Global Cellulosic Fire Protection Intumescent Coatings Market

Global Molecular Quality Controls Market

Global Capillary Blood Collection Devices Market

Global Refurbished Medical Imaging Equipment Market

Global Aerodynamic Market

Global Bio-based Lubricants Market

North America Adenomyosis Drugs Market

North America Edible Insects Market

Global Neuro-Stimulators Market

Global Risk Management Software Market

North America Insulin Market for Type 1 And Type 2 Diabetes Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness