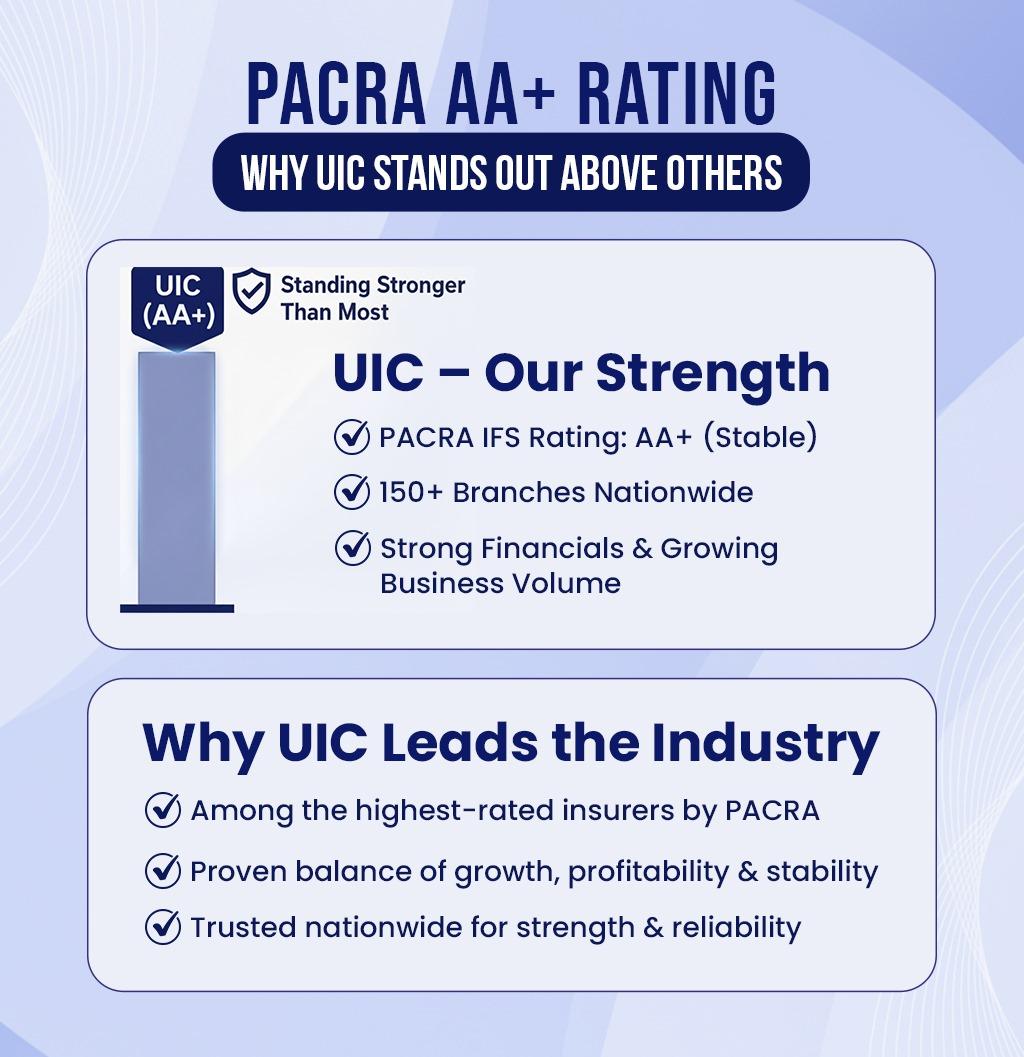

United Insurance Company of Pakistan A Trusted Name with PACRA’s AA+ Financial Strength Rating

The Pakistan Credit Rating Agency Limited (PACRA) is one of the foremost credit rating agencies in Pakistan. It provides independent assessments of the creditworthiness of companies, debt instruments, and financial entities. Among its many functions, PACRA assigns an Insurer Financial Strength (IFS) rating to insurance companies (both life and non-life), which reflects their ability to meet policyholders’ and contract obligations.

An IFS rating indicates how well an insurer is positioned financially: how sound its capital, reserves, investment portfolio, underwriting practices, reinsurance arrangements, governance structure, and risk management are. High IFS ratings are those like AAA, AA+, AA, A+ etc., usually with modifiers and outlooks (Stable, Positive, Negative) depending on projected performance.

How PACRA Assesses Insurance Companies

PACRA’s rating methodology for insurers involves multiple dimensions. The following are among the key criteria:

-

Capitalization & Solvency: How much capital the insurer holds vs. its obligations (claims, liabilities). Does it maintain reserves? Does it have enough solvency margin?

-

Underwriting Performance: This includes the combined ratio (claims plus expenses vs premiums), loss ratios, how diversified their risk portfolio is (geographically, by type of insurance, etc.).

-

Reinsurance & Risk Transfer: How effectively the insurer offloads risk to reinsurance. Quality of reinsurance partners, treaties, and how much risk is retained by the insurer.

-

Investment Portfolio & Liquidity: The quality and diversification of investments; how liquid assets are vs long-term obligations; risk of loss in investments; whether the insurer has assets that can easily meet claims.

-

Governance & Management Quality: Corporate governance practices; board oversight; risk management systems; strategy; ability to respond in adverse conditions.

-

Business Profile & Market Position: Brand strength, premium income (growth, consistency), market share, distribution network, products offered, customer service, regulatory environment.

-

Economic & Regulatory Environment: Inflation, interest rates, regulatory requirements, taxation, legal environment. Insurers operating in more stable macro conditions will generally have less risk.

PACRA combines quantitative metrics (financial results, ratios, growth) with qualitative judgments (management strategy, risk control) to assign an IFS rating. The rating includes a forward-looking outlook (like Stable, Positive, or Negative) to reflect expected performance under plausible future scenarios.

Why the PACRA Rating Matters

For insurance companies, regulators, policyholders, and investors, the rating has several implications:

-

Trust and Credibility: A higher rating signals to policyholders that the insurer is financially strong, able to pay claims on time, manage risks, and maintain solvency. It helps in marketing and competitive positioning.

-

Regulatory Compliance & Confidence: Regulators may consider ratings in licensing, monitoring, and solvency oversight. Companies with lower ratings may come under higher scrutiny or have to hold more capital.

-

Access to Reinsurance & Financing: Insurers with strong PACRA ratings often get better reinsurance terms, because reinsurers see lower counterparty risk. Also, financing (e.g. lines of credit, investment/investors) tends to be easier or cheaper for well-rated insurers.

-

Pricing & Product Development: Insurers must balance risk, underwriting costs, and pricing. To maintain a good rating, they may constrain overly risky underwriting or adjust premiums.

-

Consumer Protection: Policyholders are safeguarded by knowing which insurers are more reliable. If a consumer is choosing between two companies, the PACRA rating is an objective metric that helps.

Some Examples of PACRA Ratings in Practice

Here are several insurance companies in Pakistan and what their PACRA ratings show, to illustrate how ratings are used in real life, and what moves in ratings signal.

-

Reliance Insurance Company Limited has a PACRA IFS Rating of A+ (Stable Outlook). This means it is considered strong in its ability to meet obligations; its underwriting, investment, governance, etc. are good.

-

Habib Insurance Company Limited: PACRA has maintained its IFS rating as Stable recently, reflecting that while the general insurance industry is facing challenges (inflation, increased claims costs, etc.), Habib’s governance, sponsorship, and relative stability have been sufficient.

-

State Life Insurance Corporation of Pakistan (SLIC) is another key example. Its rating is very high (often AAA or near the top), supported by government guarantee and strong market position. As per recent reports, SLIC’s rating is maintained based on its robust distribution network, experienced management, growing business volumes, and the government’s backing of its liabilities.

-

Pak-Qatar General Takaful Limited (PQGTL) has maintained an A rating (stable outlook). This shows that even newer/in Islamic insurance / Takaful business models can perform well if they maintain strong governance, risk absorption capacity, good brand recognition, and sound reinsurance arrangements.

-

Alfalah Insurance was upgraded by PACRA to AA+. This upgrade reflected growth in business, strong underwriting performance, conservative risk retention, strong reinsurance partnerships, and sound management.

These examples show what differentiates a strong insurer (higher rating) vs one that is more vulnerable (lower rating or with constraining outlook).

Challenges, Risks & What Can Drag Ratings Down

Even well-rated companies face risks. PACRA also factors what could go wrong, and sometimes lowers ratings or outlooks. Some challenges that insurers in Pakistan typically face:

-

High Claims Inflation: Rising medical, repair, property rebuild costs make claims more expensive. Also, fraud or adverse selection.

-

Volatile Macroeconomic Conditions: Inflation, currency fluctuations, changing interest rates affect investment returns, cost of liabilities, and purchasing power of reserves.

-

Regulatory / Legal Risks: Regulatory changes (tax, solvency requirements), mandatory health or insurance programs, or changes in insurance law. Also delays in legal enforcement or litigation risk.

-

Reinsurance Cost & Availability: If reinsurers increase cost or if global reinsurers see Pakistan as higher risk, reinsurance treaties may be more expensive or less generous. That raises the insurer’s retained risk and lowers risk absorption capacity.

-

Liquidity & Asset-Liability Mismatches: If an insurer invests in illiquid assets or mismatches durations of claims vs investments, it may not be able to meet short-term obligations.

-

Management or Governance Weaknesses: Poor controls, weak underwriting discipline, strategy missteps can lead to losses, reserve shortfalls, compliance issues, or reputational damage.

-

Competition & Pricing Pressure: To gain market share, some insurers may underprice risk, leading to losses. Also competition from Takaful operators or newer entrants.

-

Catastrophic or Unexpected Events: Natural disasters, pandemics, large scale liabilities, etc. can stress insurers’ capacity—if not well-prepared.

PACRA often gives an outlook of Negative or Watch when some of these risk factors are expected to worsen, or when there is instability in financials or governance.

What Insurers Should Do to Maintain or Improve Ratings

Insurers aiming for strong PACRA ratings (or to maintain them) should focus on:

-

Strong Capital Base & Reserves: Ensuring solvency margins are healthy, building surplus funds, maintaining provisions.

-

Prudent Underwriting & Risk Management: Pricing appropriately, evaluating risk, avoiding excessive exposure in volatile lines, using reinsurance wisely.

-

Diversified Business Portfolio: Spreading across lines (motor, health, property, agriculture, etc.), spreading geographic risk, product mix.

-

Quality Investment Management: Safe, diversified investment portfolio; matching investment durations to liability durations; preserving liquidity.

-

Good Governance & Transparency: Clear board oversight, audit, risk management functions, internal controls, disclosure of financials, regulatory compliance.

-

Adaptability to Regulatory Changes: Staying ahead of regulatory demands, adopting required reporting, solvency frameworks, consumer protection laws.

-

Monitoring Expenses & Claims Costs: Controlling administrative costs, fraud detection, optimizing claims handling, being cost-efficient.

What Consumers / Policyholders Should Know

For people buying insurance in Pakistan, the PACRA IFS Rating is a useful tool to evaluate an insurer. Here’s what you should do:

-

Always check the insurer’s PACRA rating. It tells you how solid they are financially and whether they are likely to fulfill their obligations.

-

Don’t just look at the rating letter — check its outlook (Stable, Positive, Negative) to see if things are expected to improve or worsen.

-

Consider how long the insurance company has held that rating. Sudden upgrades or downgrades may reflect recent issues or improvements; consistency is reassuring.

-

Review financial performance reports if available: premium growth, solvency, profitability, claim settlement reputation.

-

Compare insurers not only by price but by financial strength. A cheaper insurer with weak finances might cause risk of delayed or denied claims.

-

For large policies (e.g. health, travel, life), the security of the insurer is particularly important. Knowing an insurer has good rating gives added peace of mind; it might also affect the cost of premiums and breadth of coverage.

Conclusion

The PACRA Insurer Financial Strength (IFS) rating plays a crucial role in Pakistan’s insurance sector. It is a rigorous, multi-dimensional assessment of an insurer’s capacity to meet its obligations to policyholders — not just in normal times but also in times of stress. Insurance companies that focus on strong capitalization, prudent underwriting, sound investment practices, reinsurance, good governance, and transparent disclosures tend to earn higher ratings like AA+, AA, etc., which in turn reinforce trust in them.

For policyholders, the PACRA rating is a valuable signal of how reliable an insurer is. Checking this rating, along with considering outlooks and other qualitative aspects, helps you make informed choices.

As Pakistan’s insurance market continues to evolve—facing macroeconomic challenges, increasing health costs, regulatory shifts—the insurers who maintain strong PACRA ratings will likely be those best able to weather uncertainty, protect policyholders, and build long-term success.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness